Clean Science & Technology Ltd.

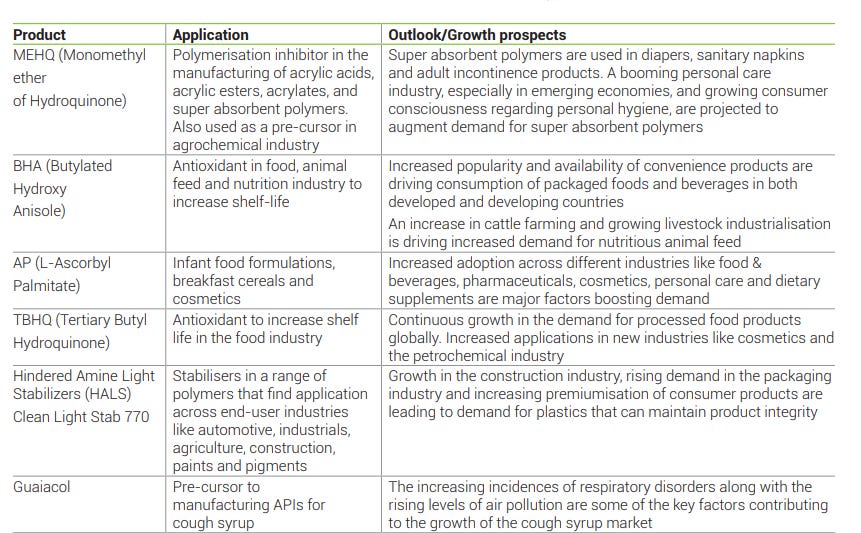

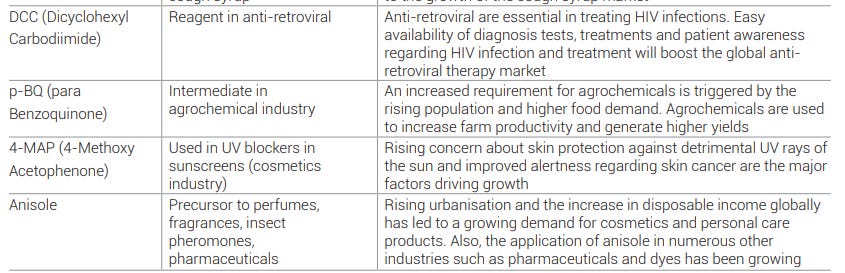

Incorporated in 2003, Clean Science and Technology Ltd is one of the leading chemical manufacturers globally. It manufactures functionally critical specialty chemicals such as Performance Chemicals (MEHQ, BHA, and AP), Pharmaceutical Intermediates (Guaiacol and DCC), and FMCG Chemicals (4-MAP and Anisole).

Company Revenue Segment-

Product Portfolio-

Performance Chemicals

Monomethyl Ether of Hydroquinone (MEHQ )

Butylated Hydroxy Anisole (BHA)

Hindered Amine Light Stabilisers (HALS)

Tertiary Butyl Hydroquinone (TBHQ )

Ascorbyl Palmitate (AP)

Product-wise Ranking-

No. 1 in the world MEHQ , BHA and AP

No. 2 in the world and India TBHQ

No. 1 in India HALS

PHARMA AND AGRO INTERMEDIATES

Guaiacol

Dicyclohexyl Carbodiimide (DCC)

Para Benzoquinone (p-BQ

PRODUCT-WISE RANKING

No. 2 in India, largest in pharma application Guaiacol

No. 1 in India P-BQ

No. 2 in the world, only Indian player DCC

FMCG CHEMICALS

4-Methoxy Acetophenone (4-MAP)

Anisole

PRODUCT-WISE RANKING

No. 1 in the world Anisole, 4-MAP

Brief use of products-

Key Highlights-

In Q3 FY24, company recovery during this quarter across volumes compared to the last quarter. Low demand globally along with incremental capacities which came up over the last couple of years, especially in China, is putting downward pressure on price realization.

In Q3 FY23, Performance segment was most impacted with realization-led decline in sales across MEHQ and BHA. Pharma segment growth was led by DCC. This improvement was volume led. And FMCG segment witnessed realization-led decline in sales. The new HALS series continued to demonstrate sequential uptick on a quarter-on-quarter basis with volume-led increase in revenue by 10%.

apex of INR225 crores incurred during the first 9 months of FY'24. Total investment in till date is INR335 crores. Installation of rooftop solar plant of 1.5 megawatts at the new facility

New products like HALS series demonstrating uptick with volume-led increase in revenue by 10%. Expectation to maintain target of 200 tons a month for HALS by March '25.

Continued focus on diversifying revenue streams with new products like TBHQ, HALS, and DCC.

Red flag Analysis-

In my research i do’t found red flag in this company with good financials numbers and company is launching new product which is unique and dominating in the market.